R&D Tax Credit Claim Process: The Definitive 5-Step Guide (2026 Updated)

If your UK business is innovating, you can recover up to 33% of your R&D costs. Following the HMRC streamlined process is critical to avoiding delays. Here is the exact 5-step workflow to secure your tax relief.

On this page:

Quick Summary: SME vs. RDEC Rates

| Feature | SME Scheme | RDEC Scheme |

|---|---|---|

| Eligibility | < 500 staff; <€100m turnover | > 500 staff; >€100m turnover |

| Benefit Rate | Up to 27% – 33% | 20% (Taxable Credit) |

| Key Requirement | Overcoming scientific uncertainty | Advancing tech/science field |

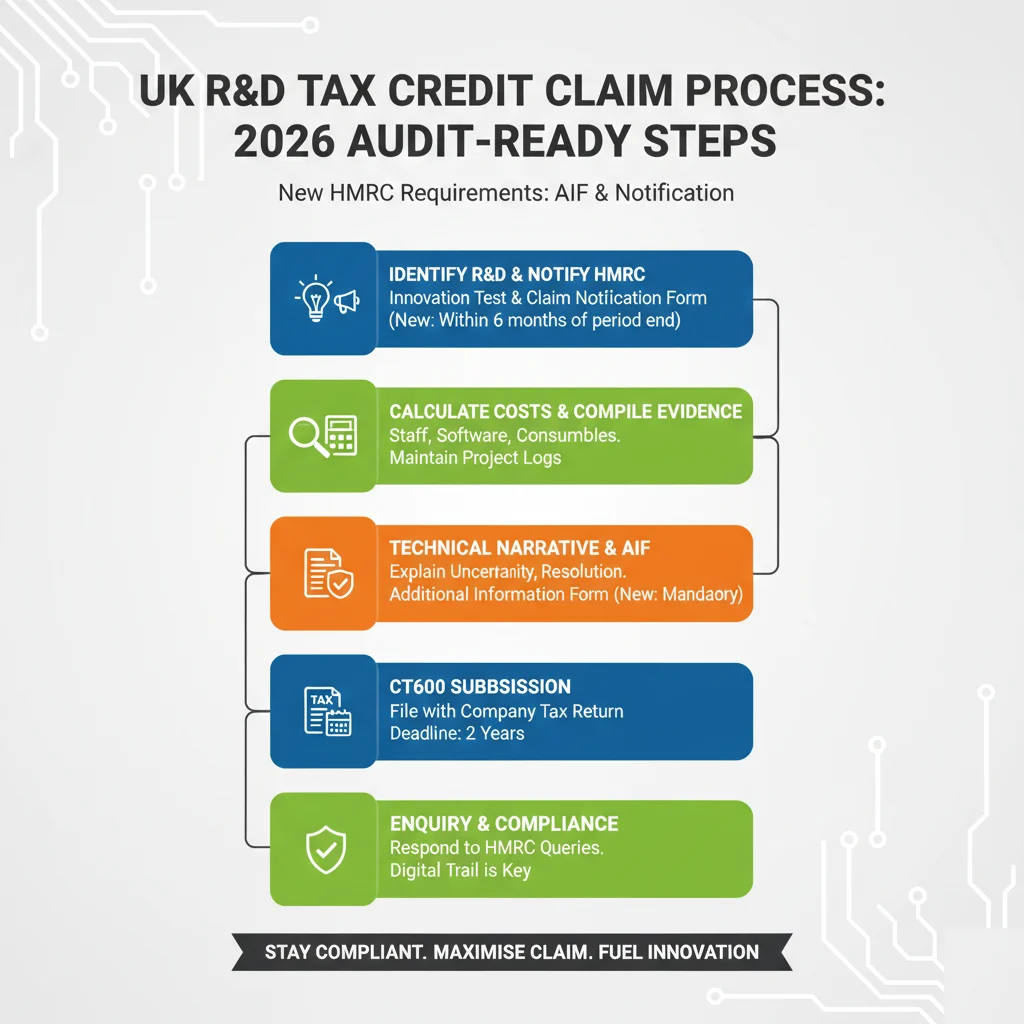

Step 1: Identify Qualifying R&D Projects

HMRC defines qualifying R&D as a project seeking an advance in science or technology.

- The Uncertainty Test: Can a “competent professional” in your field solve the problem using standard knowledge? If no, it qualifies.

- What Counts: Experimental prototyping, software architecture challenges, and process automation.

- What Doesn’t: Routine software bug fixes, aesthetic changes, or market research.

Step 2: Calculate Eligible Expenditures

To maximize your claim, categorize your costs into these five HMRC-approved buckets:

- Staff Costs: Gross pay, NI, and pension contributions (apportioned by time spent on R&D).

- Subcontractors: Generally 65% of the invoice value (SME scheme).

- Software & Cloud: Licenses for R&D-specific software and data hosting.

- Consumables: Materials, chemicals, and energy “transformed” during the project.

- EPWs: Externally Provided Workers (agency staff) supervised by your team.

Step 3: Prepare the Technical Narrative & AIF

As of August 2023, all claims must include an Additional Information Form (AIF). Your technical narrative must answer:

- The Baseline: What was the state of technology before you started?

- The Gap: Why did standard solutions fail?

- The Resolution: What was the systematic trial-and-error process you used?

Step 4: Submission via CT600

Your R&D claim is submitted as part of your Company Tax Return (CT600).

- Deadline: You must claim within 2 years of the end of the accounting period.

- Notification: If it’s your first claim, you must notify HMRC via the Claim Notification Form within 6 months of the period end.

- Timeline: HMRC typically processes SME claims in 28 to 40 days.

Step 5: Audit & Enquiry Management

HMRC has increased scrutiny to prevent fraud. To clear an enquiry quickly:

- Maintain a Digital Trail: Keep project logs, Slack/Email threads, and version histories.

- Expert Defense: If HMRC asks for more detail, provide specific technical examples rather than broad business descriptions.

Ready to see how much you can claim?

Get a free, 15-minute eligibility assessment with our UK R&D specialists. No obligation, just expert clarity.

100% Audit-Ready R&D Claims

We handle the complex technical narratives and the mandatory AIF submissions, so your claim sails through HMRC without the stress.

R&D Tax Credit Claims: Expert FAQ & HMRC 2026 Guidelines

Who is eligible for R&D claim?

Any UK limited company that is liable for Corporation Tax and is carrying out qualifying research and development activities is eligible. This includes SMEs and large companies across all sectors, provided they are seeking an advance in science or technology.

What are the new rules for R&D claims?

As of 2023 and 2024, the “new rules” include the mandatory submission of an Additional Information Form (AIF) before your CT600, a new Claim Notification Form for first-time claimants (due within 6 months of period end), and the introduction of the Merged RDEC Scheme.

What qualifies for the R&D tax credit?

Qualifications depend on overcoming “scientific or technological uncertainty.” This includes developing new products, improving existing processes, or creating software that solves a complex technical challenge that a competent professional cannot easily resolve.

What is the 33% tax credit for R&D?

Historically, loss-making SMEs could receive up to 33p for every £1 spent on R&D. Under current rules (post-April 2023), this rate has been adjusted to roughly 18.6% to 27% for most SMEs, though “R&D Intensive” companies can still access higher rates.

What are the biggest tax mistakes people make?

The most common R&D tax mistakes include failing to submit the mandatory AIF form, claiming for routine “business-as-usual” activities, and missing the 2-year statutory claim deadline.

What is the most unpopular tax in the UK?

Inheritance Tax and Council Tax are consistently cited as the most unpopular. However, for businesses, the complexity of Corporation Tax and recent changes to R&D relief rates are significant pain points.

Learn more about uk r&d tax credits