R&D Claim Notification Form

R&D Claim Notification Form: Who Needs to Submit It and How It Works

If your business undertakes research and development (R&D) in the UK, you’re likely aware of the R&D tax relief schemes designed to reward innovation. But there’s a critical step many companies overlook: the R&D claim notification form. Introduced by HMRC in April 2023, this form ensures HMRC is informed of your intent to claim R&D tax relief before you submit the full claim.

In this guide, we’ll explain what the form is, who needs to submit it, how to do it correctly, and why it matters, all in plain UK English.

What Is the R&D Claim Notification Form?

The R&D claim notification form is a pre-notification step required by HMRC. It signals your company’s intention to claim R&D tax relief for a specific accounting period.

Key points:

- The form does not replace your full R&D claim. You still need to submit a Corporation Tax return (CT600) and possibly the R&D Additional Information Form (AIF).

- It helps HMRC track potential claims, spot errors early, and manage compliance.

- It’s part of HMRC’s push for digital tax administration and increased transparency.

Think of it as giving HMRC a heads-up about your claim so the process runs smoothly.

Why HMRC Introduced the Notification Requirement

HMRC’s main goal is compliance and efficiency. The notification form helps:

- Prevent incorrect claims: Businesses occasionally submit claims without meeting eligibility criteria or properly documenting R&D activity.

- Provide early visibility: HMRC can identify potential issues before a full claim is filed.

- Streamline audits: Advance notice allows HMRC to manage R&D compliance checks more effectively.

For first-time claimants and SMEs returning after a gap, this form acts as a safety net, reducing delays and avoiding potential penalties.

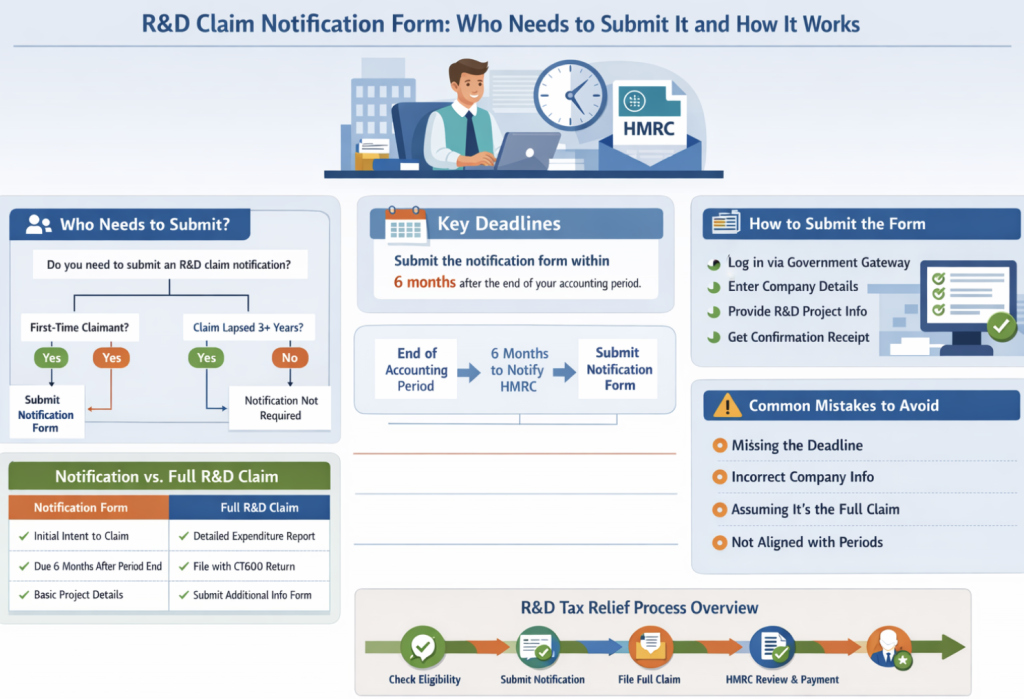

Who Needs to Submit an R&D Claim Notification Form?

Not all companies must submit this form. HMRC requires notification from:

- First-time claimants: Any company making its initial R&D claim must submit the notification.

- Companies with no claims in the past three accounting periods: HMRC uses this to maintain oversight of dormant or returning claimants.

Exceptions

You do not need to submit the form if:

- Your company has claimed R&D relief within the last three accounting periods.

- You are filing minor adjustments or routine corrections.

Example 1: A start-up making its first R&D claim for 2025 must notify HMRC within six months of its accounting period ending. Example 2: A business that last claimed R&D relief in 2021 and now submits a 2024 claim must also notify HMRC first.

For more information, see our guide on who qualifies for R&D tax relief.

Deadlines and Time Limits

Deadlines are strict. HMRC requires the notification form to be submitted within six months after the accounting period ends.

Key Deadline Points:

- Six-month window: For example, if your accounting period ends 31 March, the notification is due by 30 September.

- No extensions: Late submissions may delay your R&D claim.

- Impact of missing deadlines: Your claim may still be eligible, but processing could be delayed or additional steps required.

Keeping a visual timeline of accounting period ends, notification submission, and full claim submission can help you manage deadlines effectively.

How to Submit the R&D Claim Notification Form

Submitting the form is online only via HMRC’s Government Gateway. Here’s a step-by-step guide:

- Access the online portal: Ensure your company is registered on the Government Gateway.

- Enter company details: Provide your company registration number, accounting period, and contact information.

- Provide claim summary: Indicate whether your R&D claim falls under the SME R&D scheme or the RDEC scheme.

- Agent submissions: Authorised accountants or R&D tax agents can submit on your behalf.

- Confirmation: HMRC will issue an electronic receipt; save this for your records.

What Happens After Submission?

Once HMRC receives your notification:

- They acknowledge receipt digitally.

- The notification does not approve the claim; it merely signals intent.

- HMRC may request clarification if anything seems inconsistent.

- You can then submit the full R&D claim, including the Additional Information Form if required.

Think of the notification as preparing HMRC to handle your claim efficiently.

Common Mistakes to Avoi

Many businesses make simple errors with the notification form. Avoid these pitfalls:

- Assuming notification replaces the claim – You still need the full CT600 submission.

- Missing the deadline – Use reminders to avoid late submissions.

- Incorrect company details – Even small mistakes can trigger delays.

- Accounting period mismatches – Ensure the notification aligns exactly with your claim period.

Using checklists and visual timelines can reduce errors, especially for first-time claimants.

How This Fits into the Full R&D Tax Claim Process

The notification form is a step within the wider R&D tax claim journey:

- Eligibility check: Verify your project qualifies under HMRC R&D guidance.

- Notification form: Submit if required for first-time or returning claims.

- Full claim submission: File CT600 and, if necessary, the Additional Information Form.

- HMRC review: The claim may be audited or queried.

- Claim approval: Tax relief is applied or reimbursed.

By understanding each step, you can plan ahead, reduce errors, and avoid unnecessary delays.

Related Concepts and Entities

To fully grasp the process, it’s helpful to know related concepts:

- SME R&D Scheme: Provides enhanced tax relief for small and medium enterprises.

- RDEC Scheme: A taxable credit for larger companies’ R&D activities.

- Qualifying expenditure: Includes staffing costs, consumables, software, and subcontracted R&D work.

- HMRC compliance checks: Notifications help reduce the likelihood of audits.

- Digital-first approach: This form is part of HMRC’s ongoing digital administration.

Including these entities strengthens semantic relevance and signals topical authority to search engines.

Here are common queries about R&D claim notification forms:

- Do I need to submit a notification form for my first claim?

- Can I submit a claim without prior notification?

- How long do I have to submit the notification form?

- What happens if HMRC rejects my notification?

Answering these questions in your content helps target featured snippets and improves AI query alignment.

Tips for Businesses Submitting R&D Notifications

- Plan ahead: Track accounting period ends and deadlines.

- Use authorised agents: They minimise errors and ensure compliance.

- Keep accurate records: Document R&D projects and qualifying expenditure.

- Stay updated on HMRC guidance: Rules and forms may change over time.

- Double-check submissions: Confirm company numbers, accounting periods, and claim types.

Visual Timeline for Submission Process

Visual guide steps:

- Accounting Period Ends

- Submit Notification Form (within six months)

- Submit Full R&D Claim

- HMRC Review

- Claim Approval

This visual makes the submission process clear and easy to follow.

Competitive Advantage: Why This Guide Stands Out

Many guides merely restate HMRC rules. This guide offers:

- Clear differentiation between notification, Additional Information Form, and full claim.

- Decision-tree style explanation of who must notify and when.

- Practical tips, timelines, and examples for UK SMEs.

- Conversational yet authoritative tone that balances technical accuracy with accessibility.

By combining entity clarity, structured explanations, and actionable advice, this guide is search-engine and AI-friendly, optimising for multiple related queries.

Conclusion

The R&D claim notification form is a small but crucial step in claiming R&D tax relief. It ensures HMRC is aware of your intent, reduces errors, and streamlines compliance.

By understanding who needs to submit it, when, and how, businesses can avoid delays and confidently navigate the R&D claim process. For first-time claimants, returning SMEs, or multi-period filers, early preparation, accurate submissions, and professional guidance are the keys to a smooth, successful R&D claim.

Learn more about uk r&d tax credits